TOMS VAT Calculation Examples - the post-Brexit edition

posted 20th March 2023

When I originally wrote my first version of this TOMS VAT guide way back in 2017, it was the first article I ever published on LinkedIn and I was really blown away by how many people read it, and gave me feedback on how helpful it had been. It struck me recently that people may still be relying on the VAT advice within the article, and TOMS has changed in a few important ways since Brexit, so here is “TOMS VAT Calculation Examples 2.0 – the post-Brexit edition”.

The TOMS VAT calculation can be a bit of a mountain to climb. Post-Brexit, that mountain has reduced substantially, so we’ll now call it a medium sized hill. However, it is still a strange variation to the normal VAT rules, and can still be a bit tiring without the right equipment. The good news is that in about 95% of cases, once the TOMS calculation has tailored for your business, and the relevant data is gathered from systems, the calculation itself is a reasonably straightforward annual process with a couple of extra sums in the in-year quarterly VAT returns. So here I have provided some of the basic equipment needed for TOMS VAT hill climbing which will hopefully give you a bit of a leg up...

For those unfamiliar with the Tour Operators’ Margin Scheme (TOMS), the rules apply where any UK business buys in and sells on travel services in its own name without material alteration anywhere in the world. In the UK, HMRC define these travel services as tourist accommodation; transport; excursions; car hire; guides; and use of airport lounges. They can also include catering and admission (plus “similar services”) if supplied within a package with one or more of the first six. The effect of TOMS is, broadly speaking, that:

- The supplier is unable to recover any input VAT on direct costs of sales; and

- The supplier charges VAT on the direct margin made, at the standard VAT rate for UK travel and the zero VAT rate for non-UK travel.

How is TOMS VAT calculated?

VAT under TOMS is calculated in a very different way to normal output VAT accounting, and I would suggest here that you treat it very separately from any other type of sale from the outset. One of the key points I often advise businesses about the TOMS calculation itself is to get everything cordoned off within the accounting system - for example, by using separate accounting codes for TOMS sales and direct costs compared to other income streams, and ensuring that these codes do not themselves hit the VAT return automatically (the TOMS calculation needs to be done outside the accounting system unless anyone has found some sort of “unicorn” accounting package that automatically calculates TOMS for their exact business…).

The standard way of calculating VAT under TOMS is to account for the VAT on a “provisional” basis throughout the year, and then true this up at year end via an “annual adjustment”. The VAT payable on a provisional basis for each year is determined by the previous year’s annual adjustment calculation. As such, it is useful here to start with the annual adjustment calculation, as below.

A couple of other general comments here before we get on to the calculations:

- The standard TOMS calculation includes both UK and non UK sales (unless specific prior permission is granted from HMRC in advance). Therefore, all sales should be entered into the TOMS calculation. The difference here is that the margin made on non UK sales is zero rated rather than standard rated but due to the way the calculation is performed, the non UK activities will still have an effect on the overall VAT paid under TOMS.

- Some of the complexity can relate to what income and costs are included in the TOMS calculation. Generally speaking, TOMS turnover should be gross income from TOMS supplies, and cost should be total (VAT inclusive) direct cost of sales. I haven’t written about this in detail here to avoiding over-complication, but please bear in mind that the correct data should be gathered before you start the calculation and please get proper advice on this point for your own business, as this is one area that we often see businesses under- or overpay in TOMS VAT.

- Please note that the information and examples below are general and are not tailored to a specific business type. I would always recommend obtaining advice specific to your business here, as there are variations to TOMS VAT calculations depending on your specific business circumstances. As such, using general information alone can often mean that important elements for your specific business are overlooked. The below is a taster, and to hopefully show you that the process is not as daunting as some guidance would lead you to believe! For specific advice tailored to your business, please contact us.

The TOMS annual adjustment (also normally used quarterly in first year of business)

The annual adjustment is carried out in the first VAT return following the financial year end, and concerns all trips which have departed within that financial year (or standalone TOMS services if your business only sells, for example, accommodation under these rules). For the examples below, I have assumed that the year end is 31 December and the company completes VAT returns on a calendar quarterly basis.

Example 1:

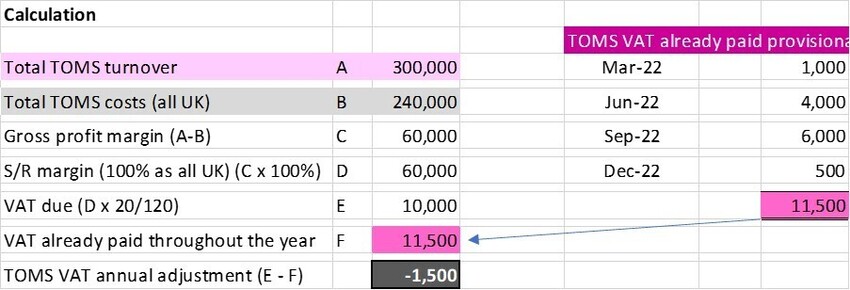

A basic example – if your business sells only UK TOMS services with no in-house services or transport company.

Here, the calculation is fairly straightforward. Once you have established total TOMS turnover and total TOMS direct costs from your systems, the calculation is simply one minus the other to get the standard rated margin. The margin is produced gross and so, to calculate VAT due, the VAT is "carved out" of the margin. At a current VAT rate in the UK of 20%, this is: margin x 20/120. To work out the adjustment due, this figure is then compared to the amount of VAT paid under TOMS in the in-year VAT returns. You will then either end up with a positive figure (an amount due to HMRC) or a negative figure (an amount owing back to you).

Example 2:

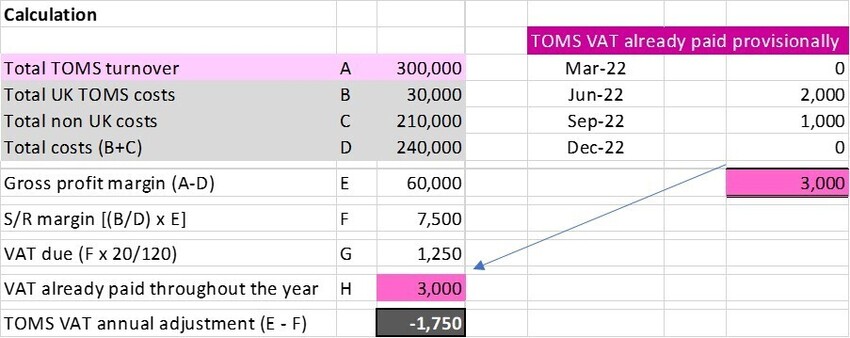

UK vs non UK example – if your business sells TOMS services taking place inside and outside the UK but has no in-house services or transport company.

Again, once turnover and direct costs have been established correctly, the difference here is that only the UK margin will be standard rated for VAT purposes. The calculation therefore needs to compute what proportion of the margin relates to UK travel, and this is done by apportioning costs. Once the standard rated margin is found, the VAT calculation is standard rated margin x 20/120 (assuming a 20% VAT rate). To work out the adjustment due, this figure is then compared to the amount of VAT paid under TOMS in the in-year VAT returns.

Example 3:

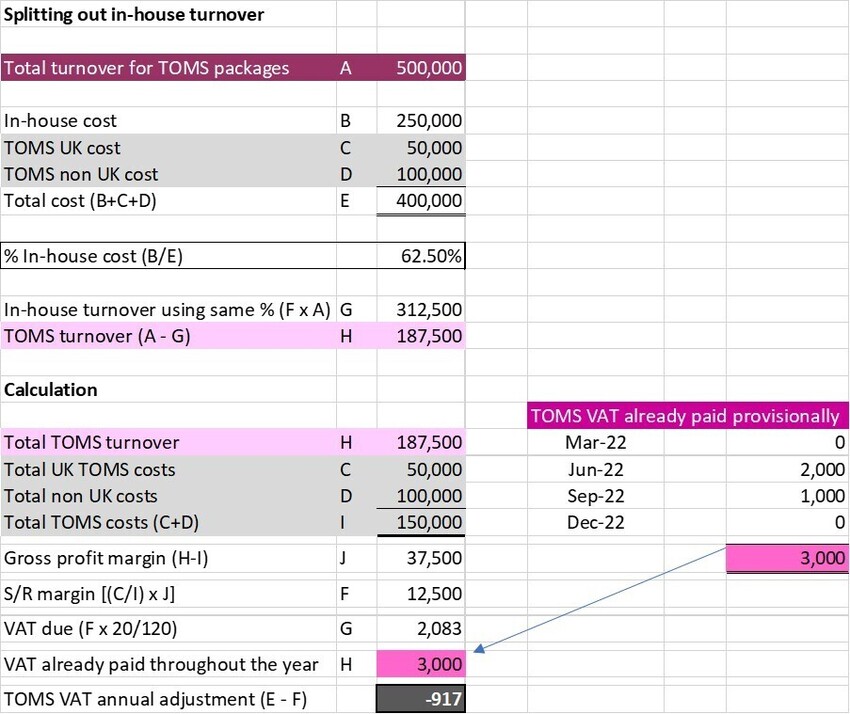

UK vs non UK with in-house – if your business sells TOMS services taking place inside and outside the UK plus provides in-house services as part of “TOMS packages”.

There are two ways of splitting turnover between in-house and TOMS - the cost based apportionment method and the market value basis. Here, I will use the cost-apportionment method to calculate the in-house element as this is the most straightforward to evidence and can normally be used by any business unless the market value approach is likely to give a very different, and more realistic, result.

Although there are several ways of doing this, I find it easier to calculate in-house turnover prior to the TOMS calculation itself. This means that, once the in-house turnover is found, the rest of the turnover relates to TOMS, and then the TOMS calculation can be carried out very similarly to example 2 above. Please note that the VAT treatment of in-house turnover will then need to be determined separately (it is not necessarily VAT free…it just means it is not subject to VAT within the TOMS margin calculation!) For more details about in-house services and other methods of calculating in-house turnover, please click here.

I am not covering the transport company in any of these examples here as it is not easy to simplify this for a general illustration, but the transport company can be a really useful and beneficial option for businesses which sell even a modest amount of UK transport under TOMS. Please click here or contact me directly if you would like to discuss this for your business!

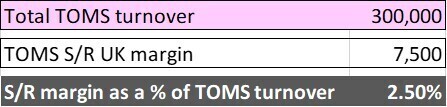

Once the annual adjustment is completed post end-year, the information compiled is also used to calculate what VAT should be paid provisionally throughout the following year. In brief, this is the percentage of your gross TOMS turnover which is VAT payable. Using the information from example 1 above, this is as below:

For each quarter of the following year, we then say that we are estimating that 2.5% of total TOMS package turnover is the standard rated margin, based on the previous year’s information (basically an “informed guess”). We now have an estimated margin, and the VAT due is then carved out of this amount using the same "margin x 20/120" calculation (based on the current UK VAT rate of 20%). For each quarter, TOMS VAT payable would therefore be calculated as TOMS turnover x 2.5% x 20/120.

This is then unlikely to be spot on because it is based on last year’s information (unless your standard rated margin as a percentage of TOMS turnover is exactly the same each year – unusual!) As such, this is then regularised in the year-end annual adjustment as above…and so on and so on…

Do I still need to do a TOMS calculation if I only sell non-UK travel?

Strictly speaking yes, a TOMS calculation is still required when a business only sells non-UK travel, even though the full TOMS margin may be zero rated. However, if all the business sells is bought-in non UK travel services, its not a huge spoiler alert to say that the calculation will usually just result a big fat zero each year. If you do not sell any UK tours, please consider these points:

- If all your services are bought in, and you have no UK purchases at all, there may be no real need to carry out a full TOMS calculation. We would still suggest carrying out a simple calculation to show an audit trail for your accountants and for HMRC (as they will often require evidence that you have continued to review your output VAT position upon a VAT inspection). This will also be required in order to accurately complete the VAT return Box 6 figure (which is the net margin for TOMS sales).

- If all your services are bought-in and take place outside the UK, but you have some UK costs such as pre-flight accommodation and airport lounges, or airport transportation, then you will still need to carry out a TOMS calculation and pat VAT provisionally as usual. It is just that the amounts of VAT payable will drastically reduce from its pre-Brexit levels.

- If all your services take place outside the UK but you also have some in-house services, you will still need to carry out a TOMS calculation in order to establish in-house turnover and VAT payable under the normal rules on this proportion of turnover.

I hope this is helpful and has given a bit of reassurance that the TOMS calculation is not a huge cause for alarm and is not exactly Mount Everest! I would stress here that it is important to ensure that the calculation works well for your business and as such that advice is taken to ensure that your particular business circumstances are reflected in your TOMS calculation method. This will help ensure that the calculations are accurate and optimal for your business.

As always, please do contact us with any comments or questions.