The billback rules...explained in full!

posted 17th September 2019

When I first heard the term "billback", I thought it was some sort of sophisticated version of cashback...not so! The VAT billback rules are really important for businesses in the travel sector (and beyond) who wish to act as disclosed agent, especially those such as Travel Management Companies (TMCs) who act for corporate clients.

The rules are often referred to as the "hotel billback" rules, but this term is a little misleading in that the rules apply equally for agents arranging hotels as they do for agents arranging other travel, and indeed, non-travel services, so long as the circumstances fit.

I have emphasized corporate travel here, because an important concept for billback purposes is the issue of VAT recovery for the customer. However, it is still important to some degree for agencies with non-corporate customers, to ensure that the invoicing position reflects that of an agent.

We are often asked to review business' VAT position to confirm whether or not they are set up correctly as disclosed agents. Time and time again, one of our main comments is that the billback rules are not being applied correctly, which can cause all manner of issues for both the agent and their corporate customer. As such, we thought it would be useful to set out the billback rules in full!!

What do the billback rules do?

Remember here that, if a travel business acts as principal, TOMS is likely to apply. Under TOMS, input VAT is not recoverable by either the travel business or its customers, so the use of TOMS makes the travel services 20% more expensive for a corporate customer. If however a business acts as disclosed agent, the TOMS rules do not apply because the business is not itself “supplying” the services but instead acting as an intermediary in arranging for the supplier and the customer to contract with each other. As such, for many businesses, avoiding TOMS is key to their profit margins and customer retention.

I have talked in earlier articles about how to be an agent for VAT purposes . Importantly here, a business acting as disclosed agent should not receive or issue invoices in its own name for the services it intends to act as agent for, because it is not itself “supplying” or “receiving” the service. Instead, for disclosed agents:

- The supplier should invoice the customer directly for the full amount due from the customer (because the supplier is making a sale directly to the customer)

- If the supplier is paying commission to the agent, the agent should invoice the supplier for the commission/fee amount only; and

- If the customer is paying the commission to the agent, the agent should invoice the customer for this commission/fee only.

This however creates a bit of a dilemma - the corporate customer needs to be named on the supplier’s invoice, but the agent needs to receive the invoice because how else would it be able to take and process payments between the supplier and customer? The agent also wants to handle all the administration on behalf of its corporate customer to facilitate the process. The corporate customer need to know how much to pay the agent, for both these travel services and the agent’s own fee (if applicable), but the agent can’t invoice for the travel services otherwise its agent status may be at risk.

So how do we deal with this?? Answer: Billback!

What are the billback rules?

HMRC acknowledge that these rules make it difficult for agents to carry out their duties fully, and so in 2010 released HMRC Revenue Brief 21/10 setting out their agreed solution - the billback rules. These 8 steps must all be followed to ensure that the invoicing rules for agents, and the input VAT recovery position for corporate customers, are met :

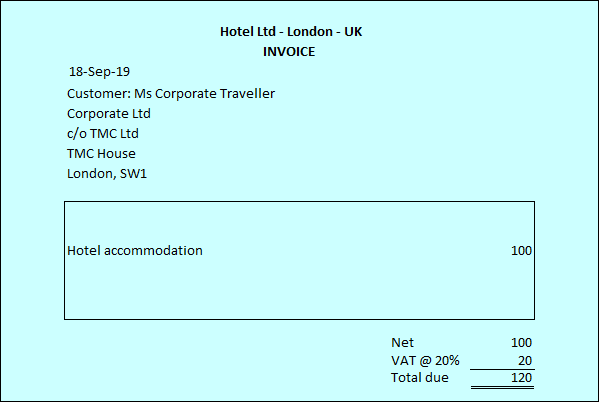

- 1. Invoices from suppliers (e.g. the hotel, car hire company) should be addressed to the corporate customer “c/o” the agent for payment, and the booking field on the supplier invoice should identify the traveller and their company. In the example here (blue example picture) the traveller is Ms Corporate Traveller, the customer is Corporate Ltd, the agent is TMC Ltd, and the supplier is Hotel Ltd;

- 2. The agent will pay the full invoice(s) (£120 in this example) but will not recover the input tax;

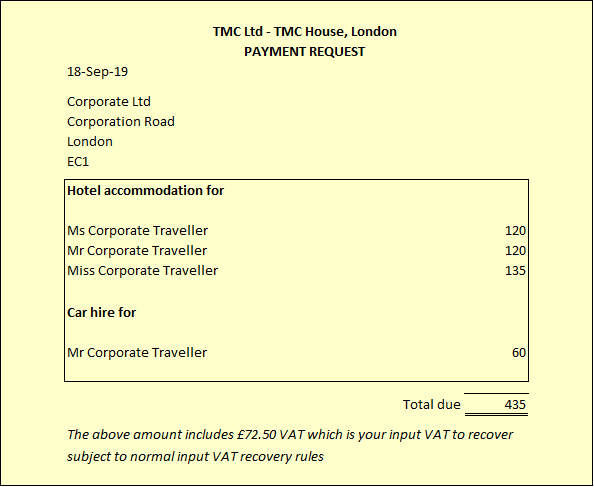

- 3.The agent would issue the corporate customer with a “payment request/summary statement” which would set out the total gross amount payable to the supplier (which the agent has already paid on behalf of the customer). This document should not in itself be a VAT invoice. In this example (yellow picture example) I have shown a typical payment request, which would include not just one trip but all trips arranged by the TMC for Corporate Ltd in a period. All these amounts are gross, and you will see that the amount for Ms Corporate Traveller (as per the blue example picture above) has been transposed into this payment request exactly as it is received from the supplier. There is no mark up or fee - it is a pure disbursement for VAT purposes;

- 4. There should be a statement somewhere on this payment request which says 'VAT of £[insert] was incurred on this booking which is your input tax which can be reclaimed subject to the normal rules' or similar;

- 5. This document allows the corporate customer to reclaim the input VAT without the need for the agent to pass through to them each individual invoice;

- 6. The agent would retain the original supplier invoices and these will be made available if evidence of entitlement is required by HMRC.

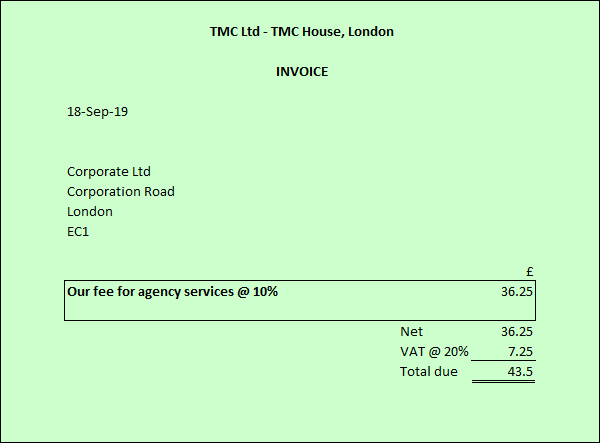

- 7. The agent would send a VAT invoice for its own services plus VAT if applicable (either alongside the statement/payment request or separately). This must be a seperate document to the payment request, and must be a proper VAT invoice so that the corporate customer can only recover the VAT on the agent's fee. In this example, please see the green invoice;

- 8. The agent would charge to the corporate client the exact amount charged by the travel supplier, as a disbursement (plus any fee it earns from the corporate client if applicable). In this example, the agent charges a total amount of £478.50 - the disbursed amounts payable to the supplier of £435 plus its fee of £43.50.

In this case, TMC Ltd would recover no input VAT, and account for £7.25 output VAT (the output VAT payable on its fee only). It should not show any of the £435 payable to the supplier in its accounts or VAT return, because this is not the agent's sale or purchase. The agent's "sale" is the fee of £36.25 plus VAT only.

Key practical issues

In practice, it is often difficult for agents to comply with these arrangements fully, because of the difficulty with suppliers’ systems, the quantity of transactions and the necessary paper trail in some cases.

The most important point here is that the travel supplier issues a VAT invoice which is addressed to the corporate customer travelling and that the agent does not issue an invoice to the corporate customer for travel services. This means that the agent will be able to pass these documents through as disbursements and none of the parties will suffer any unnecessary input VAT restrictions.

Some common practical issues include:

Amount of documentation needed to be passed through to customers: To save the need for customers to process two lots of documents, some agents like to issue a "front sheet" to summarise payments due. As long as the other two documents exist and can be accessed, this can be a good solution.

Getting suppliers to issue invoices correctly: It is common for suppliers to name the agent on the invoice, because this is the party they are corresponding with. From speaking with agents, this is much easier to do at the outset of an account set up with a new supplier, and suppliers should be told at the outset to invoice “Corporate Ltd c/o Travel Agent Ltd” or “Miss Corporate Traveller, Corporate Ltd c/o Travel Agent Ltd”. However, often I am told by agents that many suppliers still don’t naturally comply. There is no easy way around this, but many may need to be reminded repeatedly. One travel agent got good results by refusing to pay until the invoice was issued correctly, although commercially I am not sure how successful this would be for most!

International VAT recovery: Please note that billback is a UK concept and as far as I’m aware, this doesn’t apply in the same way anywhere else in the EU. In fact, in several EU countries, VAT isn’t recoverable on corporate travel regardless of the invoicing position. I would always advise confirming this with a local advisor before confirming a quote with a corporate customer, to ensure that you are aware of the VAT recovery implications.

Please contact us if you would like to discuss billback or any other VAT issues