The Golf Holidays Worldwide FTT case - TOMS and wholesale services

posted 4th September 2023

We recently had news of the FTT case decision in Golf Holidays Worldwide Ltd, which concerns the application of TOMS to wholesale services. In this case, Golf Holidays accounted for VAT on its wholesale travel packages under TOMS, and then later submitted an error correction to HMRC for overpaid VAT under TOMS, on the basis that it should not have been using the TOMS rules for wholesale services. Outside of TOMS, many wholesale operators get a great VAT position because, when selling wholesale travel packages to non-UK businesses for onwards resale, it is often possible to get the "Holy Grail" of VAT, which is to charge no VAT on sales, but achieve full input VAT recovery on the related UK purchases. We have written about this opportunity before, so please see here for details if you are a wholesaler and are not currently taking advantage of this position.

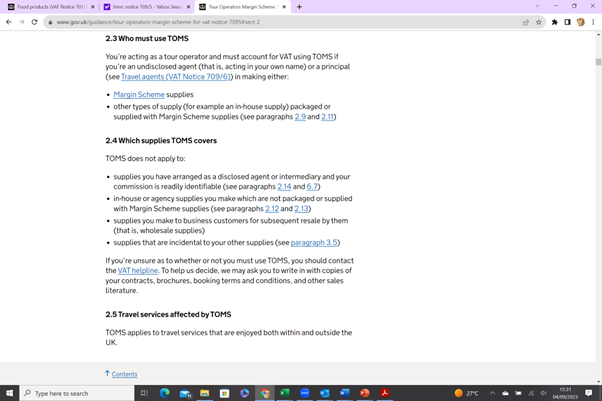

HMRC had denied the VAT repayment. The reason behind this was due to a legacy VAT position from the UK's time in the EU. In 2011, the ECJ decided in the decision of Kingdom of Spain (and others) that wholesale services should be subject to the TOMS rules. The UK never formally adopted this decision whilst we were in the EU and indeed since leaving the EU it is clear from HMRC's guidance note Notice 709/5 (see below) that wholesale services should not be in TOMS. However, whilst in the EU, HMRC confirmed that businesses could chose to apply "direct effect" of EU legislation and treat themselves within TOMS if it was advantageous to do so.

HMRC argued that Golf Holidays had decided to "opt in" to TOMS by applying direct effect of EU law. This meant that, even though the official UK position was that TOMS does not apply to wholesale travel, the fact that the business had been using TOMS was a clear indication that it had taken the optional position. Golf Holidays argued that it did not knowingly do so, and that instead it had taken its accountant's advice in using TOMS for these services. Regardless, the FTT decided that actions speak louder than words, and that Golf Holidays' use of TOMS indicated that it had consciously picked this option. With this in mind, the decision was made in HMRCs favour and Golf Holidays' error correction was rejected.

This is not good news for wholesale operators who had previously used TOMS for wholesale services (either due to a lack of knowledge or bad luck) as this suggests that any further backdated claims for VAT repayments on this basis may be rejected. We had not seen HMRC use this argument before and many claims for wholesale operators previously using TOMS had been accepted by HMRC without reference to this point.

The rules surrounding historic EU law and how this relates to the UK post-Brexit are complex, and we should still consider how this may affect VAT claims for wholesale operators now and going forward.

There are however several pieces of good news from this case - firstly, the fact that HMRC chose to argue this point rather than question the underlying principles of the wholesale package "single supply" argument is good news for operators. The VAT treatment of wholesale packages is a point which was challenged heavily when we started submitting these claims back in 2013, but which HMRC have never taken to court. It gives a further suggestion that HMRC believe the arguments that a wholesale package can be treated this way to be valid. Secondly, it is good for many sectors to see HMRC arguing for the use of TOMS, as there have been murmurings about whether HMRC may seek to abolish TOMS in the UK altogether. This suggests that HMRC do see some validity (read, money for them!) in keeping TOMS available.